Introduction to Crypto world

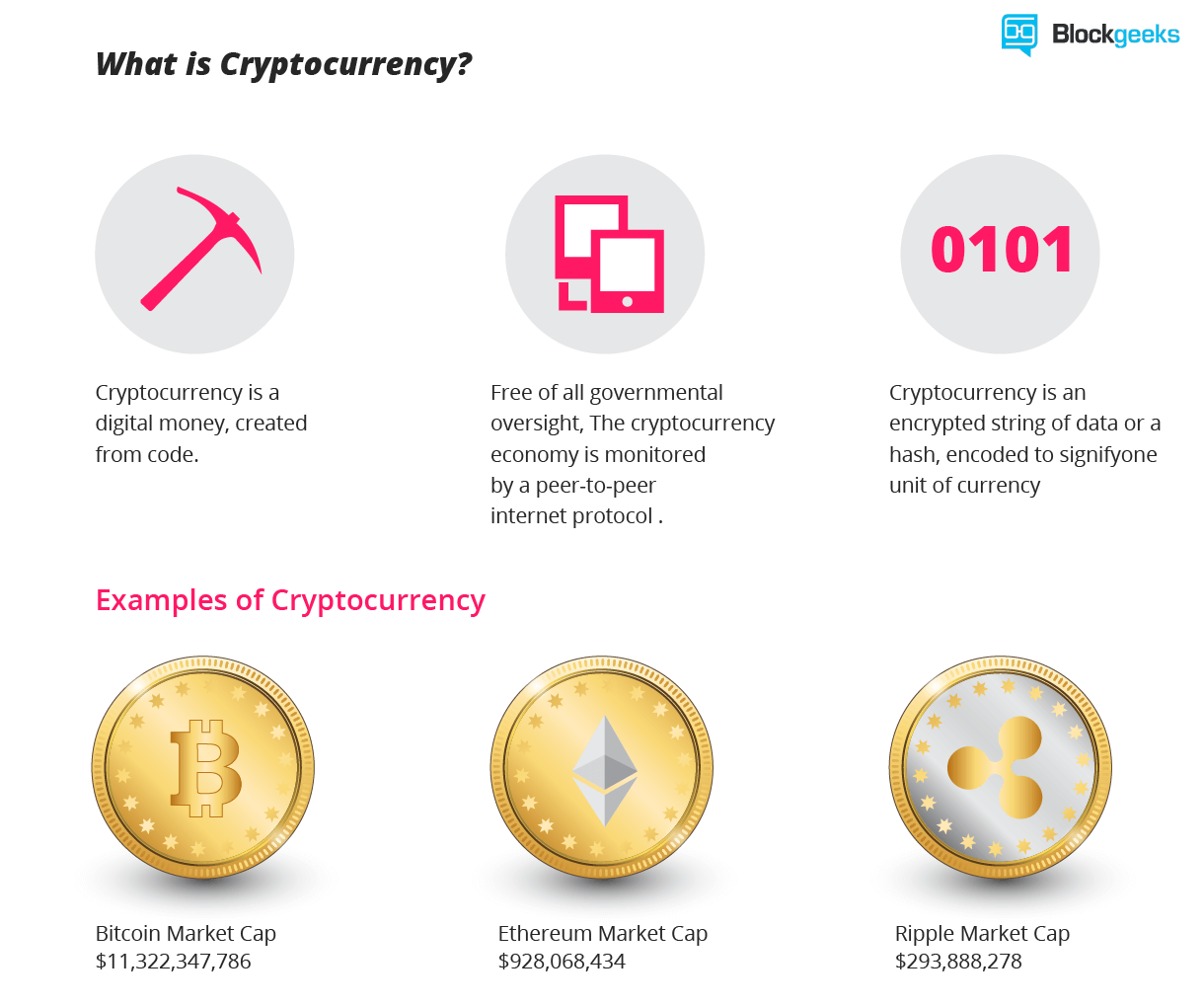

Basically, cryptocurrencies are entries about token in decentralized consensus-databases. They are called CRYPTOcurrencies because the consensus-keeping process is secured by strong cryptography. Cryptocurrencies are built on cryptography. They are not secured by people or by trust, but by math. It is more probable that an asteroid falls on your house than that a bitcoin address is compromised.

Describing the properties of cryptocurrencies we need to separate between transactional and monetary properties. While most cryptocurrencies share a common set of properties, they are not carved in stone.

Transactional properties:

1.) Irreversible: After confirmation, a transaction can‘t be reversed. By nobody. And nobody means nobody. Not you, not your bank, not the president of the United States, not Satoshi, not your miner. Nobody. If you send money, you send it. Period. No one can help you, if you sent your funds to a scammer or if a hacker stole them from your computer. There is no safety net.

2.) Pseudonymous: Neither transactions nor accounts are connected to real-world identities. You receive Bitcoins on so-called addresses, which are randomly seeming chains of around 30 characters. While it is usually possible to analyze the transaction flow, it is not necessarily possible to connect the real world identity of users with those addresses.

3.) Fast and global: Transaction are propagated nearly instantly in the network and are confirmed in a couple of minutes. Since they happen in a global network of computers they are completely indifferent of your physical location. It doesn‘t matter if I send Bitcoin to my neighbour or to someone on the other side of the world.

4.) Secure: Cryptocurrency funds are locked in a public key cryptography system. Only the owner of the private key can send cryptocurrency. Strong cryptography and the magic of big numbers makes it impossible to break this scheme. A Bitcoin address is more secure than Fort Knox.

5.) Permissionless: You don‘t have to ask anybody to use cryptocurrency. It‘s just a software that everybody can download for free. After you installed it, you can receive and send Bitcoins or other cryptocurrencies. No one can prevent you. There is no gatekeeper.

Monetary properties:

1.) Controlled supply: Most cryptocurrencies limit the supply of the tokens. In Bitcoin, the supply decreases in time and will reach its final number somewhere in around 2140. All cryptocurrencies control the supply of the token by a schedule written in the code. This means the monetary supply of a cryptocurrency in every given moment in the future can roughly be calculated today. There is no surprise.

2.) No debt but bearer: The Fiat-money on your bank account is created by debt, and the numbers, you see on your ledger represent nothing but debts. It‘s a system of IOU. Cryptocurrencies don‘t represent debts. They just represent themselves. They are money as hard as coins of gold.

To understand the revolutionary impact of cryptocurrencies you need to consider both properties. Bitcoin as a permissionless, irreversible and pseudonymous means of payment is an attack on the control of banks and governments over the monetary transactions of their citizens. You can‘t hinder someone to use Bitcoin, you can‘t prohibit someone to accept a payment, you can‘t undo a transaction.

As money with a limited, controlled supply that is not changeable by a government, a bank or any other central institution, cryptocurrencies attack the scope of the monetary policy. They take away the control central banks take on inflation or deflation by manipulating the monetary supply.

“While it’s still fairly new and unstable relative to the gold standard, cryptocurrency is definitely gaining traction and will most certainly have more normalized uses in the next few years. Right now, in particular, it’s increasing in popularity with the post-election market uncertainty. The key will be in making it easy for large-scale adoption (as with anything involving crypto) including developing safeguards and protections for buyers/investors. I expect that within two years, we’ll be in a place where people can shove their money under the virtual mattress through cryptocurrency, and they’ll know that wherever they go, that money will be there.” – Sarah Granger, Author, and Speaker.

Cryptocurrencies: Dawn of a new economy

Mostly due to its revolutionary properties cryptocurrencies have become a success their inventor, Satoshi Nakamoto, didn‘t dare to dream of it. While every other attempt to create a digital cash system didn‘t attract a critical mass of users, Bitcoin had something that provoked enthusiasm and fascination. Sometimes it feels more like religion than technology.

Cryptocurrencies are digital gold. Sound money that is secure from political influence. Money that promises to preserve and increase its value over time. Cryptocurrencies are also a fast and comfortable means of payment with a worldwide scope, and they are private and anonymous enough to serve as a means of payment for black markets and any other outlawed economic activity.

But while cryptocurrencies are more used for payment, its use as a means of speculation and a store of value dwarfs the payment aspects. Cryptocurrencies gave birth to an incredibly dynamic, fast-growing market for investors and speculators. Exchanges like Okcoin, poloniex or shapeshift enables the trade of hundreds of cryptocurrencies. Their daily trade volume exceeds that of major European stock exchanges.

At the same time, the praxis of Initial Coin Distribution (ICO), mostly facilitated by Ethereum‘s smart contracts, gave live to incredibly successful crowdfunding projects, in which often an idea is enough to collect millions of dollars. In the case of “The DAO” it has been more than 150 million dollars.

In this rich ecosystem of coins and token, you experience extreme volatility. It‘s common that a coin gains 10 percent a day – sometimes 100 percent – just to lose the same at the next day. If you are lucky, your coin‘s value grows up to 1000 percent in one or two weeks.

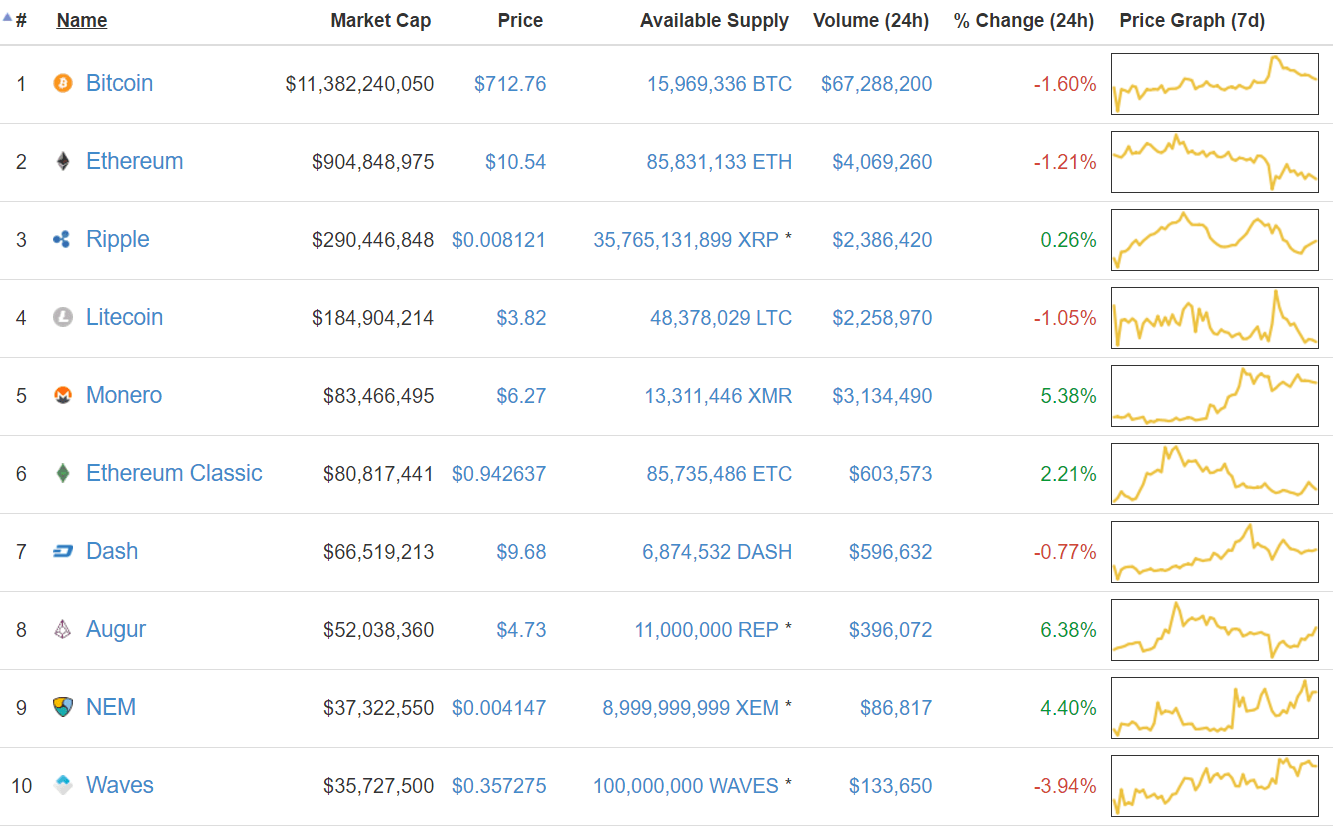

While Bitcoin remains by far the most famous cryptocurrency and most other cryptocurrencies have zero non-speculative impact, investors and users should keep an eye on several cryptocurrencies. Here we present the most popular cryptocurrencies of today.

Source: coinmarketcap

Bitcoin

The one and only, the first and most famous cryptocurrency. Bitcoin serves as a digital gold standard in the whole cryptocurrency-industry, is used as a global means of payment and is the de-facto currency of cyber-crime like darknet markets or ransomware. After seven years in existence, Bitcoin‘s price has increased from zero to more than 650 Dollar, and its transaction volume reached more than 200.000 daily transactions.

There is not much more to say: Bitcoin is here to stay.

The brainchild of young crypto-genius Vitalik Buterin has ascended to the second place in the hierarchy of cryptocurrencies. Other than Bitcoin its blockchain does not only validate a set of accounts and balances but of so-called states. This means that Ethereum can not only process transactions but complex contracts and programs.

This flexibility makes Ethereum the perfect instrument for blockchain -application. But it comes at a cost. After the Hack of the DAO – an Ethereum based smart contract – the developers decided to do a hard fork without consensus, which resulted in the emerge of Ethereum Classic. Besides this, there are several clones of Ethereum, and Ethereum itself is a host of several Tokenslike DigixDAO and Augur. This makes Ethereum more a family of cryptocurrencies than a single currency.

Ripple

Maybe the less popular – or most hated – project in the cryptocurrency community is Ripple. While Ripple has a native cryptocurrency – XRP – it is more about a network to process IOUs than the cryptocurrency itself. XRP, the currency, doesn‘t serve as a medium to store and exchange value, but more as a token to protect the network against spam.

Ripple Labs created every XRP-token, the company running the Ripple network, and is distributed by them on will. For this reason, Ripple is often called pre-mined in the community and dissed as no real cryptocurrency, and XRP is not considered as a good store of value.

Banks, however, seem to like Ripple. At least they adopt the system with an increasing pace.

Litecoin

Litecoin was one of the first cryptocurrencies after Bitcoin and tagged as the silver to the digital gold bitcoin. Faster than bitcoin, with a larger amount of token and a new mining algorithm, Litecoin was a real innovation, perfectly tailored to be the smaller brother of bitcoin. “It facilitated the emerge of several other cryptocurrencies which used its codebase but made it, even more, lighter“. Examples are Dogecoin or Feathercoin.

While Litecoin failed to find a real use case and lost its second place after bitcoin, it is still actively developed and traded and is hoarded as a backup if Bitcoin fails.

Monero

Monero is the most prominent example of the cryptonite algorithm. This algorithm was invented to add the privacy features Bitcoin is missing. If you use Bitcoin, every transaction is documented in the blockchain and the trail of transactions can be followed. With the introduction of a concept called ring-signatures, the cryptonite algorithm was able to cut through that trail.

The first implementation of cryptonite, Bytecoin, was heavily premined and thus rejected by the community. Monero was the first non-premined clone of bytecoin and raised a lot of awareness. There are several other incarnations of cryptonote with their own little improvements, but none of it did ever achieve the same popularity as Monero.

Monero‘s popularity peaked in summer 2016 when some darknetmarkets decided to accept it as a currency. This resulted in a steady increase in the price, while the actual usage of Monero seems to remain disappointingly small.

Besides those, there are hundreds of cryptocurrencies of several families. Most of them are nothing more than attempts to reach investors and quickly make money, but a lot of them promise playgrounds to test innovations in cryptocurrency-technology.

What is the future of Cryptocurrency?

The market of cryptocurrencies is fast and wild. Nearly every day new cryptocurrencies emerge, old die, early adopters get wealthy and investors lose money. Every cryptocurrency comes with a promise, mostly a big story to turn the world around. Few survive the first months, and most are pumped and dumped by speculators and live on as zombie coins until the last bagholder loses hope ever to see a return on his investment.

“In 2 years from now, I believe cryptocurrencies will be gaining legitimacy as a protocol for business transactions, micropayments, and overtakingWestern Union as the preferred remittance tool. Regarding business transactions – you’ll see two paths: There will be financial businesses which use it for it’s no fee, nearly-instant ability to move any amount of money around, and there will be those that utilize it for its blockchain technology. Blockchain technology provides the largest benefit with trustless auditing, single source of truth, smart contracts, and color coins.”

– Cody Littlewood, and I’m the founder and CEO of Codelitt

Markets are dirty. But this doesn‘t change the fact that cryptocurrencies are here to stay – and here to change the world. This is already happening. People all over the world buy Bitcoin to protect themselves against the devaluation of their national currency. Mostly in Asia, a vivid market for Bitcoin remittance has emerged, and the Bitcoin using darknets of cybercrime are flourishing. More and more companies discover the power of Smart Contracts or token on Ethereum, the first real-world application of blockchain technologies emerge.

The revolution is already happening. Institutional investors start to buy cryptocurrencies. Banks and governments realize that this invention has the potential to draw their control away. Cryptocurrencies change the world. Step by step. You can either stand beside and observe – or you can become part of history in the making.

“If the trend continues, the average person will not be able to afford to purchase one whole bitcoin in 2 years. As global economies inflate and markets exhibit signs of recession, the world will turn to Bitcoin as a hedge against fiat turmoil and an escape against capital controls. Bitcoin is the way out, and cryptocurrency as a whole is never going away, it’s going to grow in use and acceptance as it matures

Comments

Post a Comment